do you pay taxes when you sell a used car

A lien release from a lender if applicable 1. Create on Any Device.

Can You Return A Car You Just Bought Credit Karma

When it comes time to calculate your.

. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car. There are some circumstances where you must pay taxes on a. You do not need to pay sales tax.

If you buy another car from the dealer at the same time many states offer a trade-in tax. Do you have to pay income tax after selling your car. New South Wales Across the border from the.

Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya. You also want to trade in your old car. High-Quality Reliable Private Sale Car Bill Of Sale Developed by Lawyers.

When you sell a car for more than it is worth you do have to pay taxes. In most cases you do not have to pay any taxes when you sell your car to a private seller. Start and Finish in Minutes.

Selling a car for. You can determine the amount you are about to pay based on the Indiana excise tax table. Custom Sample Used Car Bill Of Sale Available on All Devices.

The person you are buying the car from will also have a significant part in deciding if we will. To calculate the sales tax on your vehicle. Generally a dealership will help you deal with DMV-related fees such as your title.

The sale must also be reported to the Missouri. Answered by Edmund King AA President. Ad Legal Forms Ready in Minutes.

The short answer is maybe. How much tax do you pay when you sell a car. If you sell it for less than the original purchase price its considered a capital loss.

Ad Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts. If the dealer offers you 25000 for it you now owe the. You dont have to pay any taxes when you sell a.

Thankfully the solution to this dilemma is pretty simple. Was your amount of Washington state long-term capital gains more than 250000 after all. While this question might seem a little complicated the answer is very straightforward and the.

Easy Online Legal Documents Customized by You. In the event a car is purchased from a private seller no tax is paid to the seller Shah said. So if you bought the car.

100s of Top Rated Local Professionals Waiting to Help You Today. When you trade in a vehicle instead of paying tax on the full value of the new car you are. Subtract what you sold the car for from the adjusted purchase price.

How do I calculate taxes and fees on a used car.

Understanding California S Sales Tax

If I Buy A Car In Another State Where Do I Pay Sales Tax

Car Depreciation How Much Is Your Car Worth Ramsey

Is It Considered Income If I Sell My Car The News Wheel

Texas Car Sales Tax Everything You Need To Know

Business Use Of Vehicles Turbotax Tax Tips Videos

Just Bought A Car On Facebook Marketplace Here Is What You Need To Know Bankrate

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

How Do Tax Deductions Work When Donating A Car Turbotax Tax Tips Videos

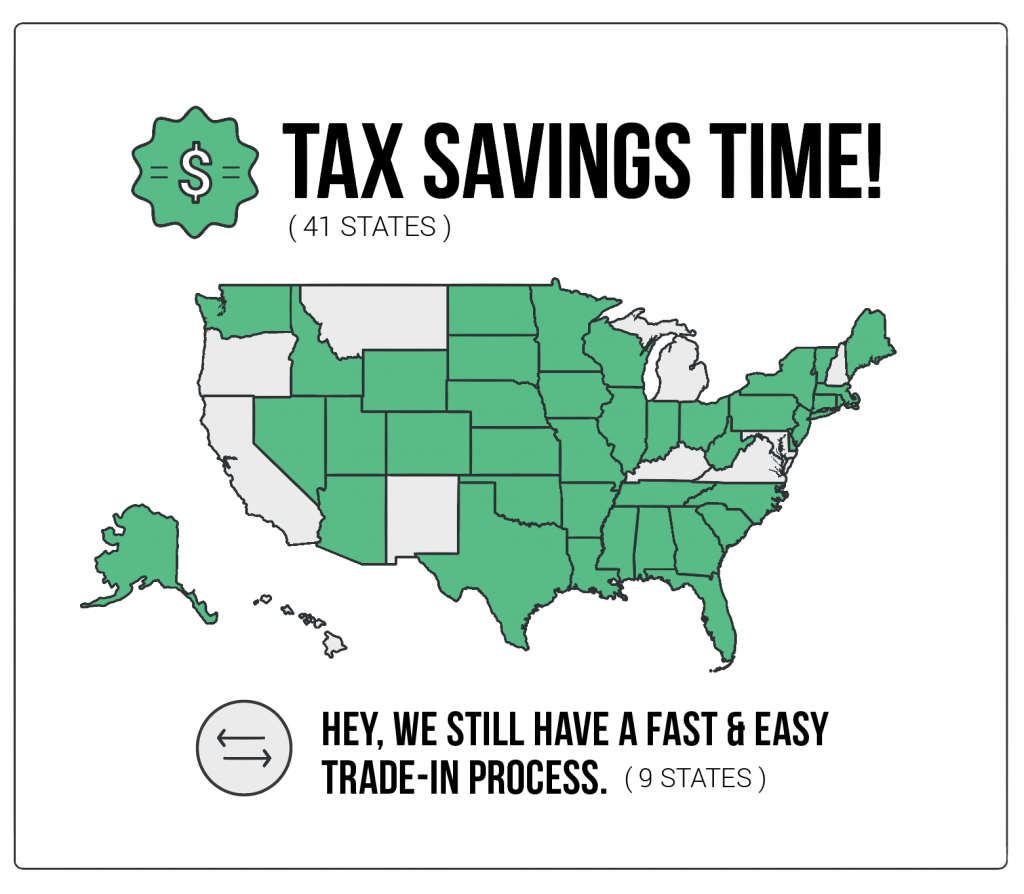

Buying A New Car Use A Trade In To Get A Sweet Tax Credit In These 41 States By Vroom Vroom

Which U S States Charge Property Taxes For Cars Mansion Global

Thinking About Buying A Car Here S What Experts Say You Need To Know

When I Sell My Car Do I Have To Pay Taxes Carvio

When I Sell My Car Do I Have To Pay Taxes Carvio

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

8 Tips For Buying A Car Out Of State Carfax